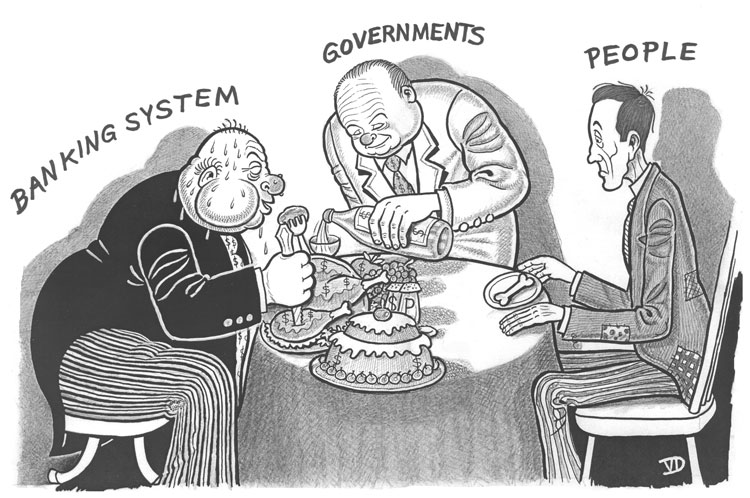

They're At It Again! Big Banks Acting As Though They Are Not Subject To The Same Rules As Everyone Else. Now They Don't Want To Take Responsibility For the Properties They Have Foreclosed On. Bankers Are Pushing Their Weight Around and Collecting Huge Profits While Expecting Others To Pay Their Bills.

This Insanity Has To Stop! Wake Up America!!

Lenders say they're owners "in name only" and don't have to pay for upkeep.

A dead dog lies among the knee-high weeds, a sign to Guillermo Elenes that the burned out, boarded up house is being used as a dump. Inside, soiled diapers, fast-food trash and the strewn beer and vodka bottles indicate squatters have been living there.

The dumping ground-crash pad serves as a squalid symbol of how the foreclosure crisis is riddling communities with blight because no one wants to shoulder the responsibility of maintaining foreclosed homes.

"There's one on every block," said Elenes, a community organizer with the Alliance of Californians for Community Empowerment in Watts, a low-income South Los Angeles neighborhood pockmarked with foreclosed homes. "All we want is for the banks to step up and be good citizens."

Communities across the nation have made little progress in getting banks to maintain foreclosed properties, and as the ongoing crisis matures and bank-owned homes fall into advanced stages of disrepair, cities and residents are getting desperate. In a keenly watched move this month, Los Angeles forged a new strategy — it sued one of the world's major financial institutions, Deutsche Bank, to force it to take care of 166 properties, both vacant and renter-occupied, charging the blue-chip German giant has turned into the city's largest slumlord.

"The buck stops with the owner of record. We're saying, 'You are an owner like any other owner,'" said Julia Figueira-McDonough, deputy city attorney.

Not according to Deutsche or other banks. They say they aren't really the owners, despite the fact that their name appears on the property title. They also say they are not responsible for maintenance.

Representatives of Deutsche, as well as U.S. Bank, BNY Mellon and HSBC — three other major lenders that Los Angeles is investigating with an eye to suing, all said that loan servicers are responsible for property upkeep, as well as tasks such as sending default notices, modifying loans, selling homes, and collecting rent and mortgage payments.

"We're there in name only," said Teri Charest, spokeswoman for U.S. Bank. "We're trustees. We have a very limited role."

The real owners, the banks say, are the holders of the mortgage-backed securities — financial instruments comprising a pool of mortgage loans that are held in a trust and sold. The banks maintain they are simply distributors of the proceeds from the securities — the payments of a homeowner's loan principal and interest — to the investors.

Although the bank contracts the loan servicer, the bank's role does not include pressing servicers to properly maintain the trust's assets on behalf of its beneficiaries, bank representatives said. U.S. Bank, however, has sent notices to loan servicers that they must maintain properties in accordance with applicable laws, a statement said.

Loan servicers, however, usually have a contract loophole that allows them an easy out from the maintenance burden.

Typically, they're only required to spend money on upkeep if they believe the outlay is recoverable, according to Laurence Platt, a Washington D.C. lawyer who has represented banks in foreclosure-related litigation.

"Who pays for a pig in a poke?" he said. "This is a collateral issue of the whole foreclosure crisis."

Calls to two of the country's largest loan servicers — Ocwen Financial Services of West Palm Beach, Fla., and Statebridge Co. of Denver, Colo. — were not returned. Houston-based Litton Loan Servicing declined to answer questions from The Associated Press. Many servicers are also owned by Wall Streeters such as Wells Fargo.

The issue of loan servicers is an attempt to dodge responsibility, Figueira-McDonough said, because the banks are the owners of record, plus have a fiduciary duty to their trust beneficiaries.

Officials in Los Angeles and other cities say they're infuriated with the back-and-forth finger-pointing while an epidemic of eyesores is devastating neighborhoods.

"We're left holding the bag. Someone has got to be held accountable," said Robert Triozzi, law director for the city of Cleveland, which unsuccessfully sued Deutsche Bank over different foreclosure-related issues three years ago. "Not only have these institutions caused this mess, they have continued to perpetuate it."

Silvia Lobato of South Los Angeles just wants repairs to the one-bedroom apartment she's been renting for the past 14 years — named as one of the neglected Deutsche Bank properties in the city's lawsuit.

The kitchen sink plumbing has a leak that has caused the unit to rot and breed worms. The bathroom ceiling is covered with mildew. A city inspector told her the gas connection to the water heater is dangerous. Mice scramble in the walls.

Everything was fine until the owner lost the duplex two years ago, said Lobato, who lives in the apartment with her three kids and another mother and her three children. Since then, she's been unable to get the landlord to make repairs.

"I call and call. They say they don't have the money. I pay $680 a month in rent," she said. "I worry about the kids in these conditions."

Governments have tried various tactics.

Los Angeles, like many cities, last year enacted an ordinance mandating that banks register defaulting properties and pay a $155 fee so the city can track the property and collect funds for expenses.

But despite the penalty of $100,000 fines for non-registration, the ordinance hasn't worked because it relies on banks to self-report the properties. "There's been minimal compliance," said Figueira-McDonough.

Other cities, including Fort Lauderdale, Fla., have tried to crack down by declaring unkempt homes "public nuisances," and charging owners, including banks, with the cost of boarding up windows and mowing lawns. In cases where no owner can be found or bills are unpaid, a lien is placed on the property.

Residents, incensed about homes on their blocks turning into drug dens, gang hangouts and vermin nests, are galvanizing.

Watts resident Lynn Mottley drives around her neighborhood looking for telltale signs of foreclosure, such as chain link fences with no trespassing signs, jotting down the addresses in a notebook she keeps in her car.

Mottley, an activist with the Alliance of Californians for Community Empowerment and the Home Defenders League, reports the addresses to the city and to lahoodwinked.com, an activist website that encourages residents to list foreclosed properties so the city can pursue owners for upkeep.

Her notebook keeps filling up. "Wow, there's another one," she said, driving by a ramshackle bungalow with broken windows and an overgrown, junk filled yard. "Who wants to live next to this? Something has to be done."

Article by Christina Hoag, Associated Press