Nassim Taleb’s book The Black Swan: The Impact of the Highly Improbable spent 17 weeks on the NYT bestseller list for good reason: it enlightened us to the vulnerability of, among other things, our financial system to random unpredictable events. Published in 2007, boy wasn’t that message timely, even if ignored?

This week, Taleb gave a rare interview in which he highlighted yet another timely message too many people seem to be ignoring. He warns the U.S. economy is in an even more precipitous position now, and more shockingly for such an academic, he explains, “Only one candidate, Ron Paul, seems to have grasped the issues and is offering the right remedies.”

Taleb refers to these issues as “the big four”:

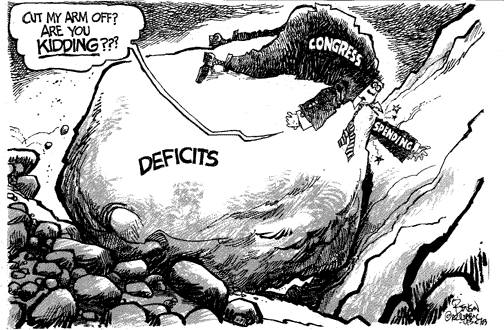

1) deficits

2) the Fed

3) militarism (as opposed to defense)

4) resilience versus bailouts

On the issue of the Fed, Taleb says Paul “is going after the Fed; he’s only one with the guts to do it.”

He is quick to point out, “I am not a Libertarian, and I am not coming from a political standpoint, but from a risk-based view of the world.”

On risk, Taleb agrees with Paul: “You don’t gamble with future generations’ money, and you don’t gamble with hyperinflation.”

2012 Republican Presidential candidate Ron Paul’s economic platform of fiscal restraint, Federal Reserve skepticism, and antipathy toward self-feeding bureaucracies was praised today by one of the world’s premier risk managers, who endorsed elements of the 12-term Congressman from Texas’ path-breaking ‘Plan to Restore America.’

Nassim Taleb told CNBC that Dr. Paul’s fiscal Mayday in areas such as the threat of an impending hyperinflation tax that will harm low- and fixed-income Americans would further harm the nation’s overall economic standing. . . . In doing so, the best-selling author . . . praised the self-trained free-market economist Paul and said of Paul, “I’m a risk-based person. From my vantage point there’s only one candidate representing the right policies.”

Finally, Mr. Taleb said that Paul is the sole person in the American political landscape that has the courage to take on the Federal Reserve and recognizes that there is no conventional, quick fix to the ruinous financial situation.